NEKUDA DOT AI

Why nekuda?

Give your agents real payment capabilities for any consumer or business use case

Secure by Design

Safely store and inject payment details at checkout with built-in compliance and security.

Instant User Authorization

Securely capture user authorization and mandates for instant approvals and minimal declines.

Trusted Payments

Establish user trust through secure payment guardrails, so users stay in control

SUPPORTING ALL AGENT TYPES

Agents

Agents

Agents

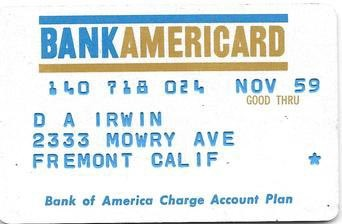

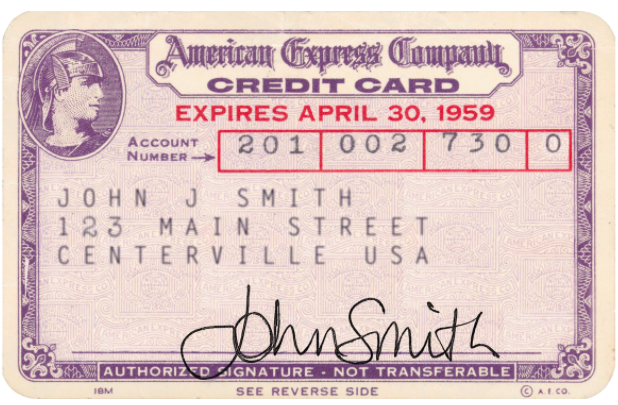

A (Short) History of Payments

2025. Let Your Agents Pay

Over 000 agents already using nekuda.ai for seamless transactions